Get the free schedule d1

Instructions and Help about schedul d 1

How to edit schedul d 1

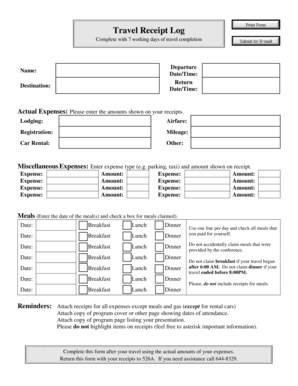

How to fill out schedul d 1

Latest updates to schedul d 1

All You Need to Know About schedul d 1

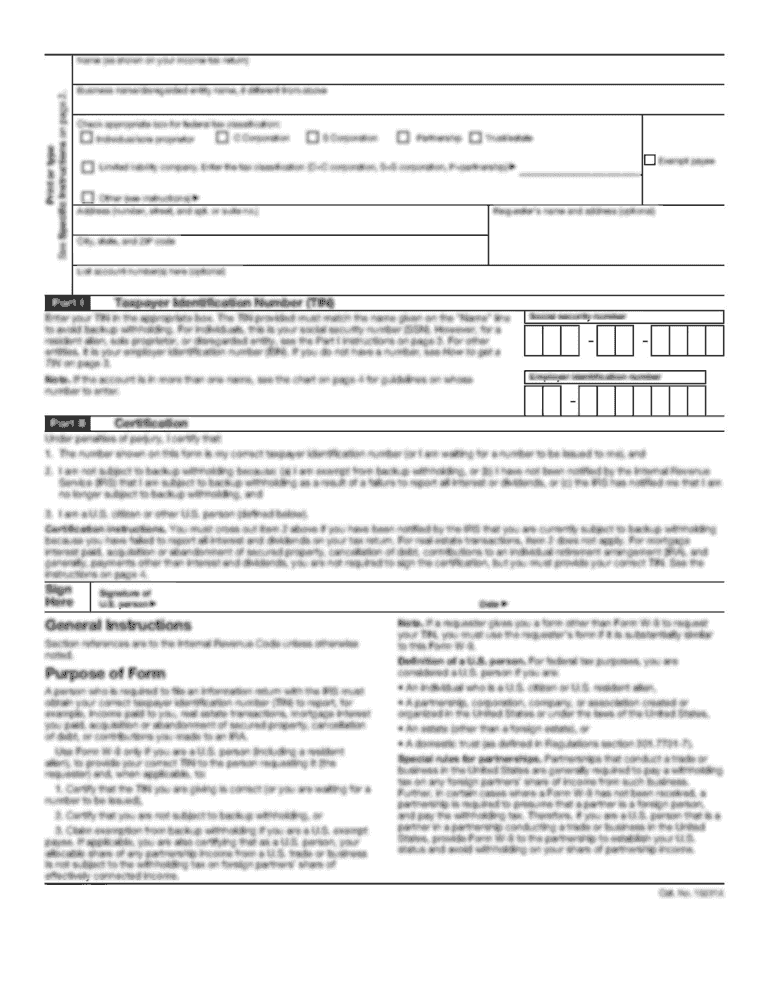

What is schedul d 1?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

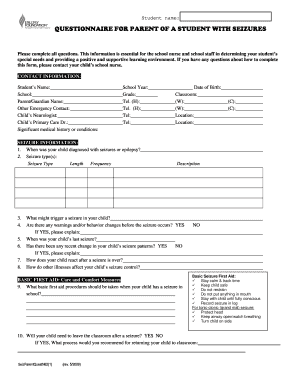

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about schedule d1 form

What should I do if I need to correct a mistake on my schedul d 1?

If you need to correct a mistake on your schedul d 1 after filing, you can submit an amended form. Ensure you indicate that it is a correction and include any relevant details about the original submission. It's best to keep a record of the amendment for your files.

How can I verify if my schedul d 1 has been received and processed?

You can verify the receipt and processing status of your schedul d 1 by checking the appropriate online portal or contacting the relevant tax authority directly. Ensure to have your submission details on hand for reference.

What are common errors to avoid when filing schedul d 1?

Common errors when filing schedul d 1 include submitting without the required signatures, incorrect taxpayer identification numbers, and mismatched information. Double-check all entries and confirm that all necessary documentation is attached before submission.

What should I do if my e-filed schedul d 1 is rejected?

If your e-filed schedul d 1 is rejected, review the rejection codes provided by the e-filing system. Correct the identified issues and submit the form again, ensuring to use the correct format and information as required.

Are there privacy and data security measures to consider when filing schedul d 1 electronically?

Yes, when filing your schedul d 1 electronically, ensure that the platform you are using complies with data security standards. It’s important to use secure networks and to be aware of privacy policies associated with the platforms to protect your personal information.